Triglav Group reaffirms its improved annual profit

guidance for 2025

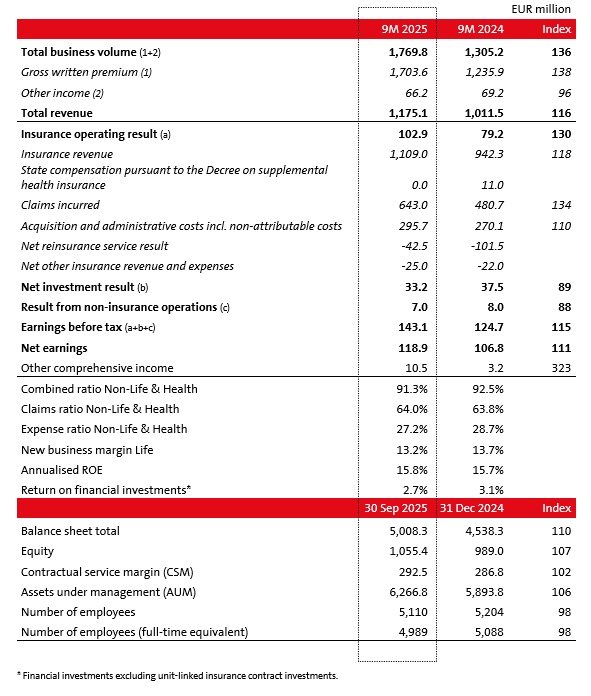

- Earnings before tax rose by 15% to EUR 143.1 million, while net earnings increased by 11% to EUR 118.9 million.

- The combined ratio Non-Life and Health reached a favourable 91.3% (9M 2024: 92.5%). The new business margin Life stood at a sound 13.2% (9M 2024: 13.7%).

- At the half-year mark, the Group raised its annual profit guidance for 2025 from the originally projected EUR 130–150 million to EUR 140–160 million. Based on the currently known business conditions expected until the end of the year, at the end of the first nine months the Group estimates that its earnings before tax will be at the upper end of the guidance range, at approximately EUR 160 million.

- In 2026, the Group's earnings before tax are projected

to reach EUR 170–190 million. According to current estimates, total business

volume will exceed EUR 2.4 billion, while the combined ratio Non-Life and

Health is expected to be around 95%.

Andrej Slapar, President of the Management Board of Zavarovalnica Triglav, commented: "We are very pleased with this year's business performance. Based on this, at the half-year mark we raised our annual profit guidance for 2025 to EUR 140–160 million. At the end of the first nine months, we estimate that earnings before tax will be at the upper end of the guidance range, at approximately EUR 160 million.

We have set high strategic ambitions for 2030, which, from our baseline, include doubling our earnings and growing our business volume and assets under management, while at the same time strengthening our international presence. We are actively pursuing these ambitions. In the first nine months of this year, we significantly increased business volume in international insurance and reinsurance markets, improved profitability across all regional markets and delivered very strong business results. In line with premium growth, claims increased; however, this was effectively offset by reinsurance. We did not experience any major CAT events. In the investment segment, we operated in volatile financial market conditions, although these did not have a material impact on the investment result. Throughout our operations, we ensured that we remained strongly capitalised and financially stable, as confirmed by this year's credit ratings of "A+" from S&P Global and "A" from AM Best.

For 2026, we plan to increase earnings before tax to between EUR 170

million and EUR 190 million, while consistently pursuing other strategic

ambitions. With a team of more than 5,000 dedicated employees, we will strive

to successfully deliver on our ambitions."

PERFORMANCE HIGHLIGHTS IN 9M 2025

The Triglav Group's total business volume reached EUR 1,769.8 million, with the 36% growth mainly driven by the Non-Life segment and, within it, its international market operations. Gross written insurance, coinsurance and reinsurance premiums grew by 38%, reaching EUR 1,703.6 million, of which EUR 308.4 million was newly generated in the Italian motor vehicle insurance market. Excluding the new business in the Italian market, this year's premium growth would have been 13%.

Written premium in the Slovenian market rose by 4% to EUR 736.4 million, and by 7% to EUR 276.6 million in other markets of the Adria region. Strong premium growth of 156% was recorded in international insurance and reinsurance markets (EUR 690.6 million). Premium increased both in reinsurance (by 50% to EUR 278.6 million) and in international insurance business (by 388% to EUR 411.9 million). The new business in Italian market, where the Group began operating in the second half of July this year, contributed the most to the latter, with written premium amounting to EUR 308.4 million. The share of the Slovenian market in total written premium decreased by 14 percentage points to 43%, while premium written in other Adria region markets accounted for 16% (9M 2024: 21%) and premium written in the international market for 41% (9M 2024: 22%).

The Group's earnings before tax rose by 15% to EUR 143.1 million, while net earnings increased by 11% to EUR 118.9 million. In the first nine months of this year, the Group operated profitably in all segments except the Health segment. The majority of earnings before tax, EUR 102.9 million, was generated by the insurance business (30% growth), driven primarily by strong performance in the Non-Life segment. Earnings before tax from the investment business totalled EUR 33.2 million (9M 2024: EUR 37.5 million), and EUR 7.0 million was generated from non-insurance operations (9M 2024: EUR 8.0 million). Zavarovalnica Triglav, the Group's parent company, generated earnings before tax of EUR 102.3 million (14% growth) and net earnings of EUR 85.1 million (9% growth).

Other comprehensive income totalled EUR 10.5 million (9M 2024: EUR 3.2 million), an increase driven by the lower impact of interest rate changes on the valuation of investments and also by the appropriate matching of asset and liability duration. The Group's capitalisation at the end of the first nine months was within the target range of 200–250%.

The combined ratio Non-Life and Health stood at a favourable 91.3%, which is 1.3 percentage points better year-on-year. The profitability of the insurance business improved in all of the Group's insurance markets. The claims development in the first nine months of this year was favourable. The increase in the claims ratio by 0.2 percentage points to 64.0% was primarily due to the one-off positive effects of the termination of supplemental health insurance that benefited the 2024 result. The expense ratio decreased to 27.2% (9M 2024: 28.7%), as the growth in revenue outpaced the growth in expenses.

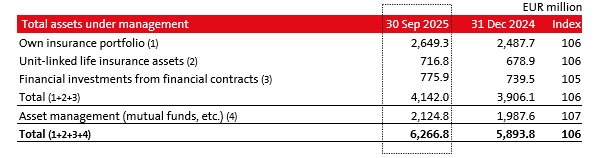

The Group's total assets under management remained broadly unchanged in composition compared to 31 December 2024. Their volume, however, increased by 6% to EUR 6.3 billion. In volatile financial market conditions, the Group achieved a 2.7% rate of return on investments (9M 2024: 3.1%), excluding unit-linked insurance assets. This year's rate of return is largely comparable to last year's, excluding the effect of exchange rate differences on investments, which are offset by changes in insurance provisions, and the impact of business growth in the Italian market on the value of financial investments.

TRIGLAV GROUP PERFORMANCE BY SEGMENT

Uroš Ivanc, a Management Board member of Zavarovalnica Triglav, said: "In the Non-Life segment, we significantly increased the size of the insurance portfolio, improved profitability and increased the insurance operating result by 78%. The net investment result in this segment remained in line with last year. The Life segment maintained a sound new business margin, increased its business volume and achieved a solid operating result. The Health segment, where the business model was restructured last year, recorded a negative result this year, as expected. Excluding discontinued operations, this year's result is comparable to last year's. We expect the segment's result to remain volatile going forward until the desired health insurance business volume is achieved. In the Asset Management segment, income from fees and the business volume increased. The result from this segment's own investments declined year-on-year, which is an expected consequence of financial market conditions."

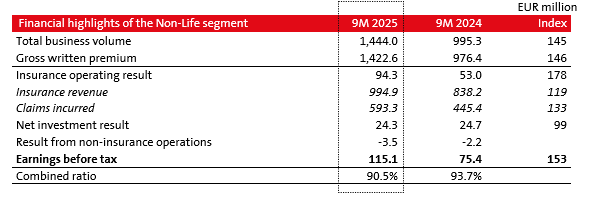

Non-Life segment

- Total business volume increased by 45%, reaching EUR 1,444.0 million.

- The combined ratio stood at a favourable 90.5%.

- Nine-month earnings before tax rose by 53%, reaching EUR 115.1 million

Total business volume increased by 45%, reaching EUR 1,444.0 million. Premium increased at a similar rate, with growth achieved across most non-life insurance groups. By market, a strong premium growth of 156% was recorded in the international market (with reinsurance premium up 134% and insurance premium up 388%). The highest premium volume was generated in Italy, Poland and Greece. Premium growth was also recorded in Slovenia and in most other Adria region markets, driven by increased sales.

Non-life insurance claims incurred increased by 33% to EUR 593.3 million. Last year, the claims provisions made in 2023 due to the floods decreased. However, claims incurred have increased this year due to the growth in portfolio size.

The combined ratio Non-Life stood at a favourable 90.5%, down 3.2 percentage points year-on-year, with both the expense ratio and the claims ratio declining. The improved ratios reflect revenue growth outpacing expense growth and an improvement in net claims development.

Earnings before tax rose by 53%, reaching EUR 115.1 million. The net investment result remained at last year's level, while the insurance operating result increased significantly. It was mainly driven by higher business volume and improved profitability of insurance business.

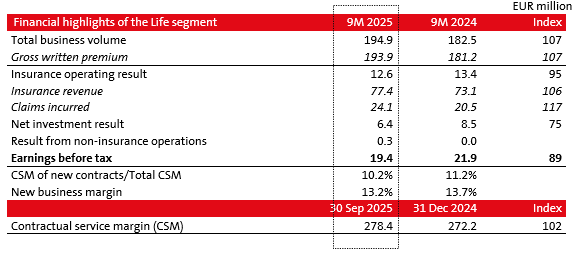

Life segment

- Total business volume increased by 7% to EUR 194.9 million.

- The new business margin reached a favourable 13.2% (9M 2024: 13.7%). The contractual service margin amounted to EUR 278.4 million, a 2% increase compared to 31 December 2024.

- Nine-month

earnings before tax amounted to EUR 19.4 million (9M 2024: EUR 21.9 million).

The total business volume of EUR 194.9 million grew by 7%, matching the growth rate of life insurance premium. Premium increased across all of the Group's insurance markets. Its growth was particularly strong in unit-linked life insurance, driven by additional premium payments.

The new business margin reached just over 13.2% (9M 2024: 13.7%).

The contractual service margin of EUR 278.4 million rose by 2% relative to 31 December 2024, while the share of the CSM of new contracts in total contractual service margin was 10.2% (9M 2024: 11.2%). The CSM of new contracts amounted to EUR 28.3 million, of which 41% was accounted for by unit-linked life insurance contracts. The release of the contractual service margin to profit or loss amounted to EUR 29.0 million compared to EUR 27.3 million year-on-year.

Earnings before tax of the Life segment amounted to EUR 19.4 million, compared to EUR 21.9 million last year. The year-on-year comparison is influenced by this year's upgrade of the annuity insurance methodology, which, among others, provides a more prudent projection of their cash flows.

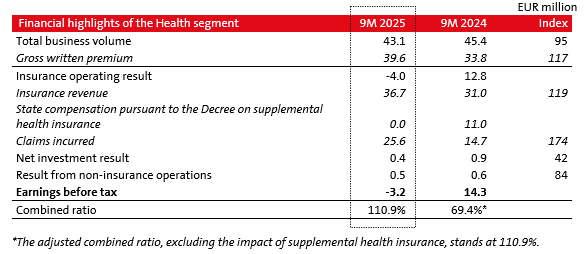

Health segment

- The total business volume amounted to EUR 43.1 million, down by 5% year-on-year (due to the state compensation received last year under the Decree on setting the maximum supplemental health insurance premium).

- The combined ratio stood at 110.9% (9M 2024: 69.4%).

- Nine-month earnings before tax amounted to EUR -3.2 million (9M 2024: EUR 14.3 million).

Following last year's restructuring of the segment's business model, the Group continued activities this year aimed at growing and developing complementary health insurance both in Slovenia and in other regional markets. The Group expects the Health segment's result to remain volatile in the coming period, as the segment is in a phase of strong growth but still has a relatively low business volume.

The segment's total business volume amounted to EUR 43.1 million this year, 5% lower than last year, which had been higher due to the effect of the termination of supplemental health insurance. Gross written premium amounted to EUR 39.6 million, up 17%, with growth achieved in most markets in the region.

The combined ratio Health stood at 110.9% (9M 2024: 69.4%). Excluding the impact of supplemental health insurance on last year’s figure, last year's combined ratio would have been the same as this year’s, i.e. 110.9%.

Earnings before tax amounted to EUR -3.2 million, compared to EUR 14.3 million year-on-year (of which EUR 16.1 million related to discontinued operations following the termination of supplemental health insurance). The segment recorded a negative result in the insurance business this year (partly due to higher claims incurred and increased claims provisions as a result of portfolio growth). The result was positive in the investment business and in non-insurance operations.

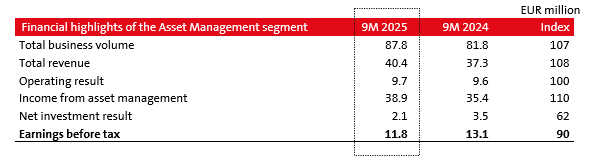

Asset Management segment

- Total business volume increased by 7% to EUR 87.8 million.

- Income from asset management (income from fees) increased by 10% to EUR 38.9 million.

- Nine-month earnings before tax amounted to EUR 11.8 million, down 10% year-on-year, due to a lower net investment result.

Total business volume increased by 7%, reaching EUR 87.8 million.

Earnings before tax amounted to EUR 11.8 million (down 10% year-on-year), influenced by a 10% increase in income from asset management (income from fees), which totalled EUR 38.9 million. The net investment result amounted to EUR 2.1 million, 38% lower year-on-year, due to a decrease in the value of equity investments from the segment's own funds.

The Group's total assets under management as at 30 September 2025 amounted to EUR 6.3 billion, a 6% increase compared to 31 December 2024.

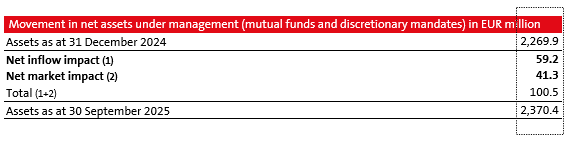

The volume of the Group's assets under management in mutual funds and discretionary mandate assets was positively influenced by both favourable financial market conditions and higher client net inflows.

PROFIT GUIDANCE FOR 2025, PLAN FOR 2026 AND STRATEGY TO 2030

(financial highlights)

- In 2025, the Triglav Group projected earnings before tax of EUR 130–150 million. At the half-year mark, it raised its annual profit guidance for 2025 to EUR 140–160 million. At the end of the first nine months, it estimates that earnings before tax will be at the upper end of the guidance range, at approximately EUR 160 million.

Based on currently known and expected business conditions in 2026, Triglav plans to further increase earnings before tax to between EUR 170 million and EUR 190 million.

The Group's 2025–2030 strategy sets out the ambition to double earnings before tax to EUR 250–300 million by 2030.

- Total

business volume in 2025 was projected to exceed EUR 1.8 billion. Triglav now expects to exceed the planned level by at least one third.

In 2026, Triglav plans for total business volume to exceed EUR 2.4 billion.

Triglav aims for its business volume to reach EUR 2.5–3.0 billion in 2030, with assets under management exceeding EUR 10 billion.

- Based on currently known and expected business conditions, Triglav estimates that the

combined ratio Non-Life and Health will be around 95% in 2026.

Its goal is to maintain the combined ratio Non-Life and Health below 95% in the 2025–2030 strategy period and achieve a net return on equity (ROE) of between 12% and 13% by 2030. - Triglav strives to position itself as a stable, safe and profitable investment for investors. It aims to pay out dividends of approximately EUR 400 million to shareholders over the period 2025–2030, in line with its dividend policy, while maintaining its target capital adequacy and ensuring the right conditions for growth and development.