At the half year point, Triglav raises its annual profit guidance for 2025

- Triglav's total business volume increased by 18% compared to H1 2024, reaching EUR 1,065.3 million, primarily driven by a rise in gross written premium in the Non-Life segment.

- Earnings before tax rose by 22% to EUR 109.6 million, while net earnings increased by 21% to EUR 91.4 million.

- The combined ratio Non-Life and Health reached an extremely favourable 88.2% (H1 2024: 90.6%). The new business margin Life stood at just over 12.2% (H1 2024: 14.1%).

- Triglav Group's capitalisation at the half-year remains within the target range of 200–250%.

Andrej Slapar, President of the Management Board of Zavarovalnica Triglav, commented: "The second quarter was also successful, with earnings before tax for the first half of the year reaching EUR 110 million. We are satisfied with the results and based on the currently available information and the expected business environment by the end of the year, we are raising our annual profit guidance for 2025. Initially projected at EUR 130–150 million, earnings before tax are now expected to reach EUR 140–160 million.

The exceptionally strong half-year results are mainly due to strong premium growth, driven by increased client insurance coverage, strong performance in the international reinsurance and insurance markets, and favourable claims development. In line with Triglav's strategic ambition of greater internationalisation, we further reduced the share in Slovenia in the premium structure, which stood at 52% at the half-year, and increased the share of international business. We have improved profitability in all insurance markets, as reflected in the favourable combined ratio.

As before, the investment portfolio was managed conservatively. Uncertain conditions in the financial markets therefore had no material impact on the net investment result, although they did influence the return and value of financial investments and assets under management to a certain extent.

This year, S&P Global upgraded Triglav Group's credit rating to "A+", with a stable medium-term outlook. Triglav remains strongly capitalised and financially stable, with business results and future prospects reflected in Triglav's share price. We have set high strategic ambitions for 2030 and, together with a team of more than 5,000 dedicated employees, are working hard to realise them."

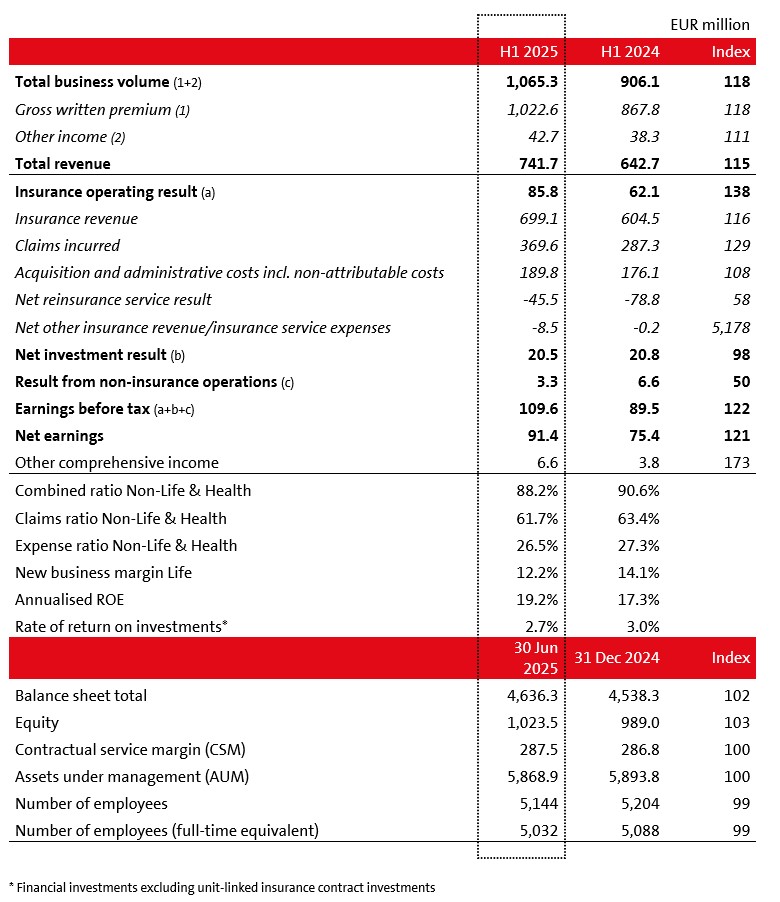

FINANCIAL HIGHLIGHTS IN H1 2025

Triglav's total business volume amounted to EUR 1,065.3 million, reflecting an 18% growth across all business segments, with the Non-Life segment contributing the most. Gross written insurance, coinsurance and reinsurance premiums grew at the same rate, reaching EUR 1,022.6 million. Written premium in the Slovenian market increased by 5% to EUR 527.4 million, by 8% to EUR 193.4 million in other markets of the Adria region, and by 61% to EUR 301.8 million in the wider international environment. The increase is attributed to a higher volume of both inward reinsurance and insurance transactions, particularly in the Polish and Italian markets. Triglav reduced Slovenia's share in the geographical premium structure by 6 percentage points to 51.6%, while the total share of the remaining markets in the region stood at 18.9% (H1 2024: 20.6%). The share of premium written in the international market increased to 29.5% (H1 2024: 21.6%), with direct business (FOS and FOE) accounting for 9.1% and reinsurance premium for 20.4%.

Triglav's earnings before tax amounted to EUR 109.6 million, up by 22% year-on-year, while net earnings increased by 21% to EUR 91.4 million. Triglav achieved profitability in all segments except the Health segment. The Group's insurance operating result amounted to EUR 85.8 million, representing an increase of 38%; the net investment result was EUR 20.5 million (H1 2024: EUR 20.8 million); and the result from non-insurance operations was EUR 3.3 million (H1 2024: EUR 6.6 million).

Zavarovalnica Triglav, Triglav Group's parent company, generated earnings before tax of EUR 79.8 million (a 20% increase) and net earnings of EUR 66.7 million (a 17% increase).

The combined ratio Non-Life and Health stood at a favourable 88.2%, 2.4 percentage points lower year-on-year. The claims ratio decreased by 1.7 percentage points to 61.7%, primarily due to favourable claims development and the absence of major CAT events. The expense ratio decreased by 0.7 percentage points to 26.5%, driven by higher growth in insurance revenue compared to expenses. The profitability of the insurance business improved in all of Triglav's insurance markets.

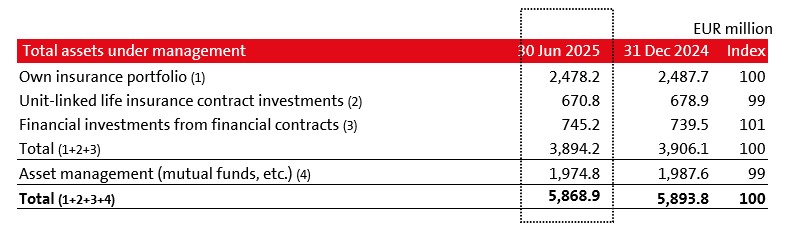

Triglav Group's total assets under management remain comparable in both composition and volume to those at the end of last year. Of the total value of EUR 5.9 billion, own funds, unit-linked insurance assets and financial contract assets amounted to EUR 3.9 billion (index 100), while assets managed in mutual funds, discretionary mandates, pension funds and alternative investments reached EUR 2.0 billion (index 99).

The rate of return on Triglav investments (excluding unit-linked insurance assets) stood at 2.7% (H1 2024: 3.0%).

TRIGLAV GROUP PERFORMANCE BY SEGMENT

Uroš Ivanc, a Management Board member of Zavarovalnica Triglav, said: "The main contributor to Triglav Group's strong half-year results was the Non-Life segment, where the insurance portfolio was expanded and high profitability achieved, alongside a solid investment result amid favourable claims development. The Life segment maintained a promising new business margin while improving its performance results. In the Health segment, which underwent business model restructuring last year, a negative result was recorded, as expected, with volatility anticipated to continue. In the Asset Management segment, income from fees and business volume increased, while the result from Triglav Group's own investments in this segment declined year-on-year due to the financial market conditions."

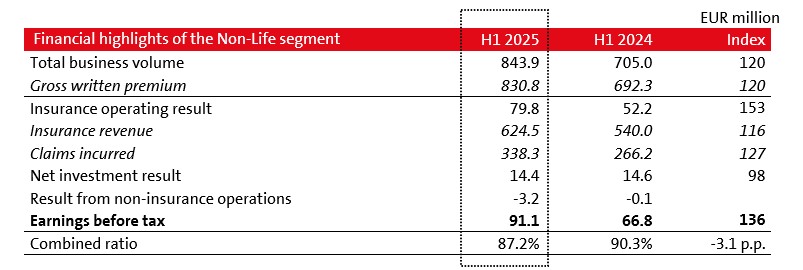

Non-Life segment

- Total business volume increased by 20%, reaching EUR 843.9 million.

- The combined ratio stood at a favourable 87.2%.

- Half-year earnings before tax rose by 36%, reaching EUR 91.1 million.

The total business volume of EUR 843.9 million grew by 20%, matching the increase in written premium. Premium growth was observed across most non-life insurance classes and in the majority of markets in the Adria region. International premium rose by 61%, driven primarily by FOS transactions related to motor vehicle insurance premium in the Polish, Italian and Greek markets.

Non-life insurance claims incurred increased by 27% to EUR 338.3 million. Last year, the claims provisions made in 2023 due to the floods decreased. However, they have increased this year due to the growth in portfolio size and claims development.

The combined ratio Non-Life stood at a favourable 87.2%, down 3.1 percentage points year-on-year, with both the expense ratio and the claims ratio declining.

Earnings before tax rose by 36%, reaching EUR 91.1 million, driven by a strong insurance operating result, while the net investment result remained at the previous year's level.

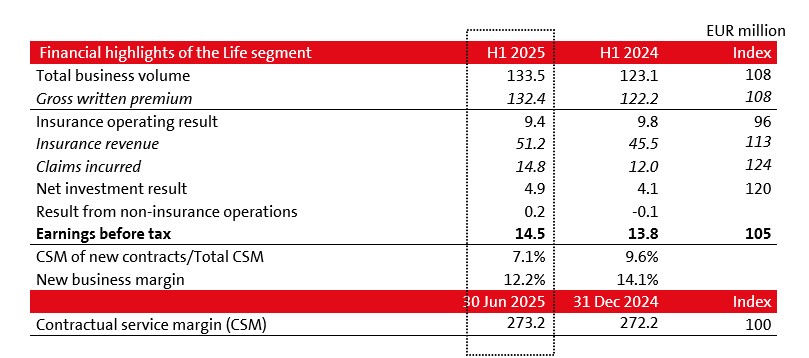

Life segment

- Total business volume increased by 8% to EUR 133.5 million.

- The new business margin reached a favourable 12.2% (H1 2024: 14.1%). The contractual service margin of EUR 273.2 million remained at the same level as at the 2024 year-end.

- Half-year earnings before tax rose by 5%, reaching EUR 14.5 million.

The total business volume of EUR 133.5 million grew by 8%, matching the growth rate of life insurance premium. Strong premium growth in unit-linked life insurance was predominantly driven by higher premium payments and effective sales through banking channels and agencies at the parent company. Premium increased across most of Triglav's insurance markets.

The new business margin reached just over 12.2% (H1 2024: 14.1%).

The contractual service margin of EUR 273.2 million remained at the 2024 year-end level, while the share of the CSM of new contracts in total contractual service margin was 7.1% (H1 2024: 9.6%). The CSM of new contracts amounted to EUR 19.3 million, of which 44% was accounted for by unit-linked life insurance contracts. The release of the contractual service margin to profit or loss amounted to EUR 19.1 million compared to EUR 15.4 million year-on-year.

Earnings before tax of the Life Segment increased by 5%, reaching EUR 14.5 million. The insurance operating result of EUR 9.4 million was impacted, among other factors, by increased claims incurred and expenses, while the net investment result stood at a solid EUR 4.9 million despite challenging conditions in the financial markets.

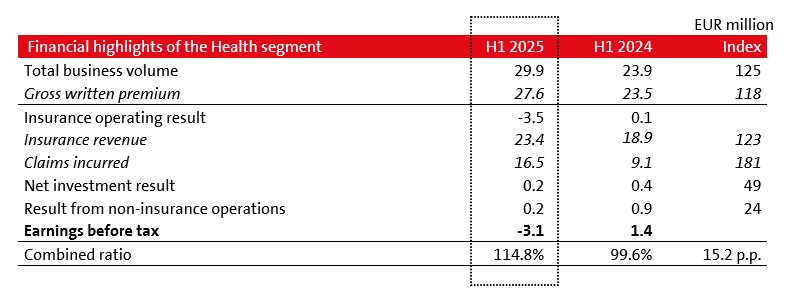

Health segment

- Total business volume increased by 25% to EUR 29.9 million.

- The combined ratio stood at 114.8% (H1 2024: 99.6%).

- Half-year earnings before tax amounted to EUR –3.1 million (H1 2024: EUR 1.4 million).

Last year, Triglav Group restructured the Health segment's business model, and this year it is continuing activities aimed at growing and developing complementary health insurance in Slovenia and other markets in the Adria region. The total business volume of the Health segment rose by 25% to EUR 29.9 million year-on-year.

Earnings before tax totalled EUR –3.1 million (H1 2024: EUR 1.4 million), including EUR 4.3 million from discontinued operations. The segment's performance in the first half of the year was negative in the insurance segment (also due to increased claims incurred driven by higher claims provisions from portfolio growth), but positive in the investment segment and non-insurance operations. Triglav Group expects the Health segment's result to be volatile in the coming period, as the segment is experiencing high growth rates and a relatively low business volume.

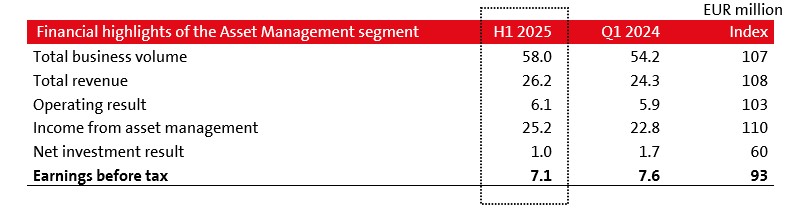

Asset Management segment

- Total business volume increased by 7%, reaching EUR 58.0 million.

- Income from asset management (income from fees) increased by 10% to EUR 25.2 million.

- Half-year earnings before tax amounted to EUR 7.1 million, down 7% year-on-year, mainly due to a lower net investment result.

Total business volume amounted to EUR 58.0 million (up by 7%).

Earnings before tax amounted to EUR 7.1 million (down 7% year-on-year). This was driven by a 10% increase in income from asset management (income from fees) amounting to EUR 25.2 million and a 40% decrease in investment result to EUR 1.0 million, resulting from a reduction in the value of equity investments from this segment's own funds.

Triglav Group's total assets under management as at 30 June 2025 amounted to EUR 5.9 billion, remaining at the same level as at 31 December 2024.

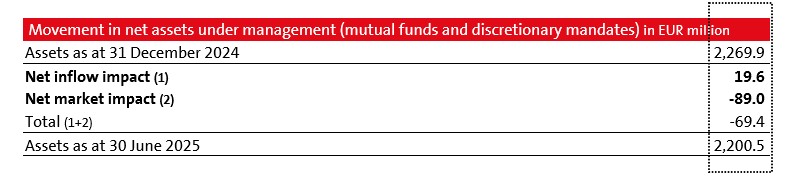

Triglav Group's assets under management in mutual funds and discretionary mandate assets were affected by the situation on financial markets.

PLAN FOR 2025 AND STRATEGY TO 2030 (financial highlights)

- In 2025, Triglav Group projected earnings before tax of EUR 130–150 million. At the half-year mark, Triglav Group raised its annual profit guidance for 2025. Triglav expects that earnings before tax in 2025 will reach EUR 140–160 million. Its strategic goal is to double it to EUR 250–300 million by 2030.

- Total business volume in 2025 was projected to exceed EUR 1.8 billion, with the half-year estimate indicating it will be one-third above plan. Triglav aims for its business volume to reach EUR 2.5–3.0 billion in 2030, with assets under management exceeding EUR 10 billion.

- Its goal is to maintain the combined ratio Non-Life and Health below 95% in the 2025–2030 period and achieve a net return on equity (ROE) of between 12% and 13% by 2030.

- Triglav strives to position itself as a stable, safe and profitable investment for investors. It aims to pay out dividends of approximately EUR 400 million to shareholders over the period 2025–2030, in line with its dividend policy, while maintaining its target capital adequacy and ensuring the right conditions for growth and development.